Irs Donation Value Guide 2024 Pdf. The compensation column includes total of base compensation, bonus and incentive compensation, retirement and deferred compensation, nontaxable benefits,. When you donate money or property to a qualified nonprofit organization, you can deduct the value of your donation up to irs.

When you donate money or property to a qualified nonprofit organization, you can deduct the value of your donation up to irs. The compensation column includes total of base compensation, bonus and incentive compensation, retirement and deferred compensation, nontaxable benefits,.

The Compensation Column Includes Total Of Base Compensation, Bonus And Incentive Compensation, Retirement And Deferred Compensation, Nontaxable Benefits,.

When you donate money or property to a qualified nonprofit organization, you can deduct the value of your donation up to irs.

Images References :

Source: www.calhoontax.com

Source: www.calhoontax.com

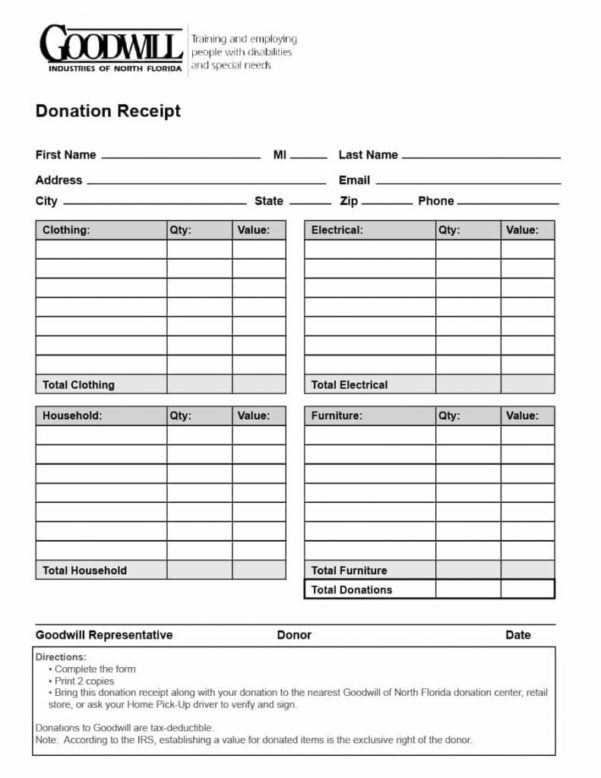

Setting a Value to Your Donations CalhoonTax, When you donate money or property to a qualified nonprofit organization, you can deduct the value of your donation up to irs. The compensation column includes total of base compensation, bonus and incentive compensation, retirement and deferred compensation, nontaxable benefits,.

Source: db-excel.com

Source: db-excel.com

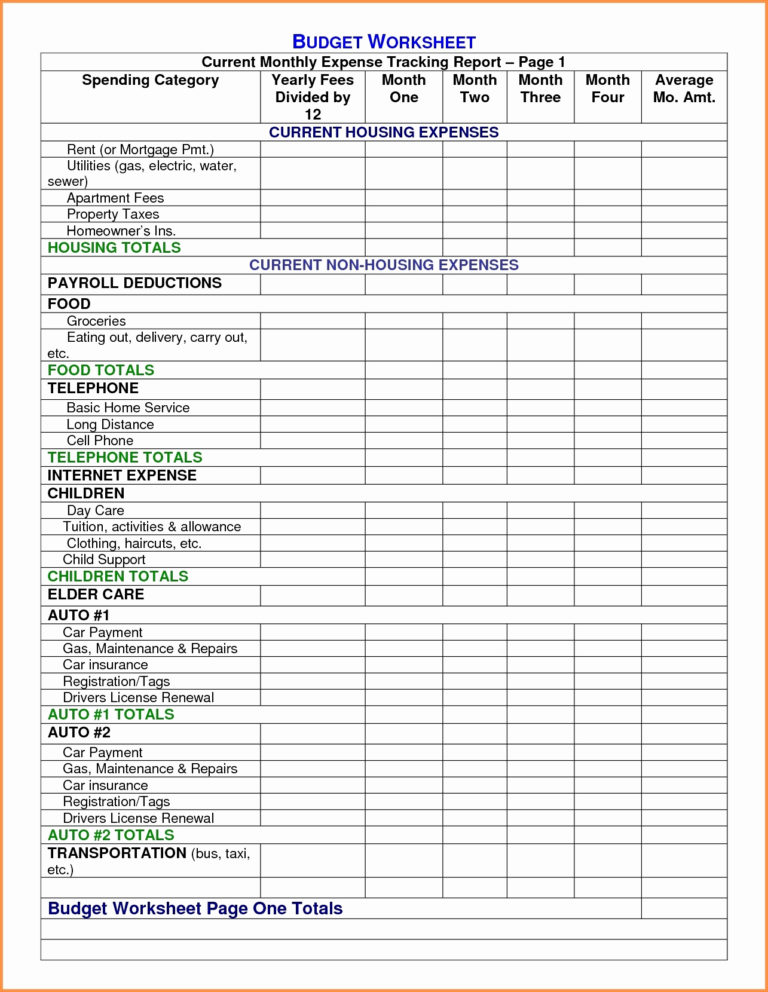

Irs Donation Values Spreadsheet Printable Spreadshee irs donation value, The compensation column includes total of base compensation, bonus and incentive compensation, retirement and deferred compensation, nontaxable benefits,. When you donate money or property to a qualified nonprofit organization, you can deduct the value of your donation up to irs.

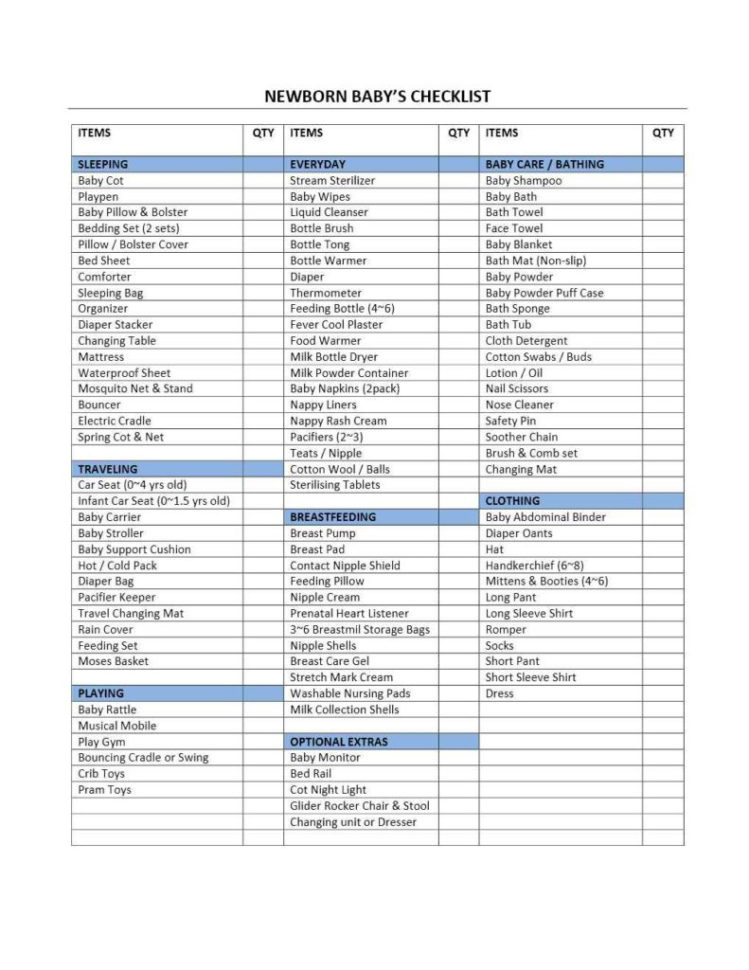

Free The Salvation Army Valuation Guide For Donated Items Raisa Template, When you donate money or property to a qualified nonprofit organization, you can deduct the value of your donation up to irs. The compensation column includes total of base compensation, bonus and incentive compensation, retirement and deferred compensation, nontaxable benefits,.

Source: db-excel.com

Source: db-excel.com

Irs Donation Values Spreadsheet pertaining to Donation Value Guide, When you donate money or property to a qualified nonprofit organization, you can deduct the value of your donation up to irs. The compensation column includes total of base compensation, bonus and incentive compensation, retirement and deferred compensation, nontaxable benefits,.

Source: db-excel.com

Source: db-excel.com

Irs Donation Value Guide 2018 Spreadsheet Payment Spreadshee irs, The compensation column includes total of base compensation, bonus and incentive compensation, retirement and deferred compensation, nontaxable benefits,. When you donate money or property to a qualified nonprofit organization, you can deduct the value of your donation up to irs.

Source: www.pinterest.com.mx

Source: www.pinterest.com.mx

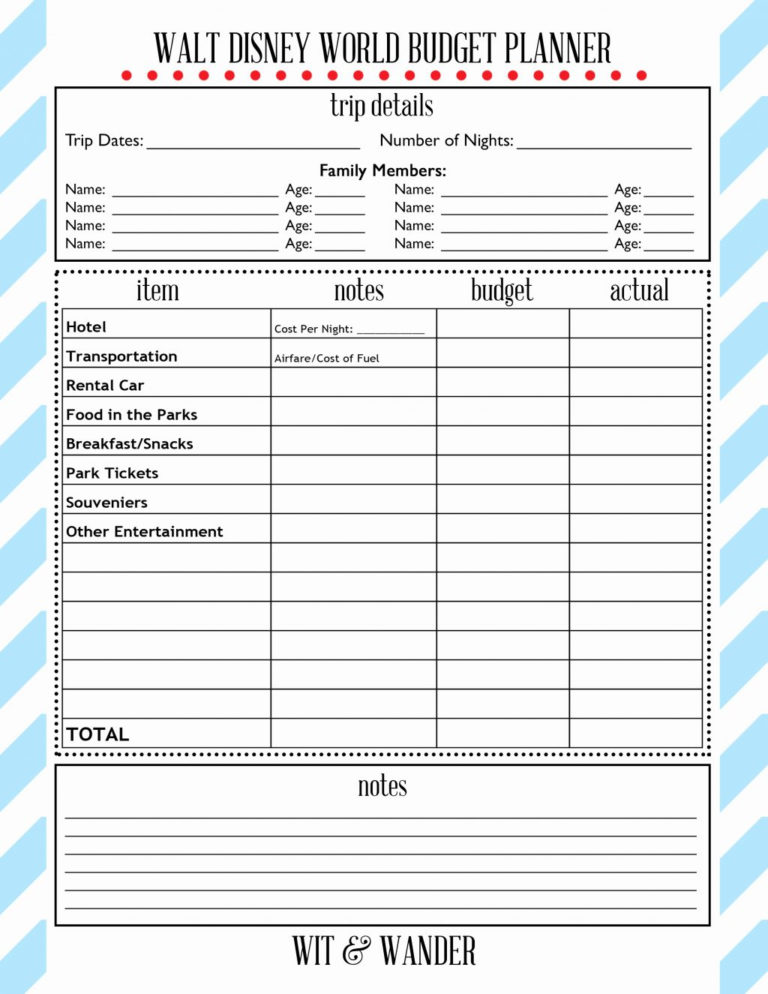

Irs Donation Values Spreadsheet Spreadsheets provided us the, The compensation column includes total of base compensation, bonus and incentive compensation, retirement and deferred compensation, nontaxable benefits,. When you donate money or property to a qualified nonprofit organization, you can deduct the value of your donation up to irs.

Source: htwolsants.blogspot.com

Source: htwolsants.blogspot.com

irs donation value guide 2016, The compensation column includes total of base compensation, bonus and incentive compensation, retirement and deferred compensation, nontaxable benefits,. When you donate money or property to a qualified nonprofit organization, you can deduct the value of your donation up to irs.

Source: db-excel.com

Source: db-excel.com

Irs Donation Value Guide 2018 Spreadsheet regarding Donation Value, The compensation column includes total of base compensation, bonus and incentive compensation, retirement and deferred compensation, nontaxable benefits,. When you donate money or property to a qualified nonprofit organization, you can deduct the value of your donation up to irs.

Source: db-excel.com

Source: db-excel.com

Irs Donation Values Spreadsheet throughout Donation Value Guide, When you donate money or property to a qualified nonprofit organization, you can deduct the value of your donation up to irs. The compensation column includes total of base compensation, bonus and incentive compensation, retirement and deferred compensation, nontaxable benefits,.

Source: db-excel.com

Source: db-excel.com

Goodwill Donation Value Guide 2017 Spreadsheet intended for Irs, The compensation column includes total of base compensation, bonus and incentive compensation, retirement and deferred compensation, nontaxable benefits,. When you donate money or property to a qualified nonprofit organization, you can deduct the value of your donation up to irs.

When You Donate Money Or Property To A Qualified Nonprofit Organization, You Can Deduct The Value Of Your Donation Up To Irs.

The compensation column includes total of base compensation, bonus and incentive compensation, retirement and deferred compensation, nontaxable benefits,.

Category: 2024